Turning 65 means you become eligible for Medicare, a federal health insurance program for senior citizens. Medicare offers two main options for coverage – Original Medicare and Medicare Advantage. However, Original Medicare does not cover all expenses. You may need additional coverage to pay for things like copays, deductibles, and coinsurance.

To offset these expenses, many individuals opt for either Medicare Supplement Insurance (also known as Medigap). They can also choose a Medicare Advantage plan (also known as Part C). Each of these options works differently. So it is essential to understand which one is most suitable for your specific needs and circumstances.

With so many options available, it is challenging to decide between Medicare Advantage and Medigap. HPO is available to provide assistance and help you get started.

Watch explainer video here >>>

What is Medicare Supplement Insurance?

This type of insurance works in conjunction with your Original Medicare coverage and helps pay for services that are not covered by Part A and Part B. These services include foreign travel and excess charges, such as when a doctor does not accept Medicare. Medigap can also assist with the cost of your Part A deductible, which is $1,556 for 2022, as well as the 20% coinsurance rates associated with Part B coverage.

It’s important to note that Medicare Supplement Insurance is not a stand-alone coverage plan. You must first be enrolled in Original Medicare. Additionally, Medigap does not include coverage for prescription medications. To obtain this coverage, you will need a third plan – Medicare Part D.

There are ten different Medigap insurance plans available, including Plans A through D, F and G, and K through N. However, Plans C and F are not available to individuals who enrolled in Medicare after January 1, 2020. Medigap insurance plans generally cover 100% of your Part A coinsurance costs and many plans cover 100% of your Part B coinsurance and copayment costs.

If you opt for Medigap, keep in mind that it will come with a monthly premium. The amount varies based on your chosen plan and could be several hundred dollars per month. Additionally, some plans may have deductibles and copays.Medigap plans do not include additional benefits such as dental, vision, over the counter items, and other coverage that is above and beyond what original Medicare provides.

What is a Medicare Advantage plan?

Medicare Advantage, or MA, is a healthcare plan that you can choose instead of Original Medicare. MA plans are provided by private insurance companies and offer the same coverage as Parts A and B, but usually also include Part D and additional benefits like routine dental, hearing, and vision services all in one policy.

By law, Medicare Advantage plans cover the same types of medical services as Original Medicare, including hospital services, doctor appointments, and lab tests. However, you may have to stay within a certain network or get a referral from your primary care physician before the plan will pay for the costs.

If you enroll in Medicare Advantage, your benefits will be administered through the private plan, which will replace your Original Medicare coverage. You will not be able to enroll in a Medicare Supplement plan or a stand-alone Part D plan.

Many Medicare Advantage plans do not charge an additional premium beyond the usual Part B premium. However, you may still have to pay a deductible, copays, and coinsurance. MA plans generally have an annual out-of-pocket maximum, which limits the amount you have to spend each year.

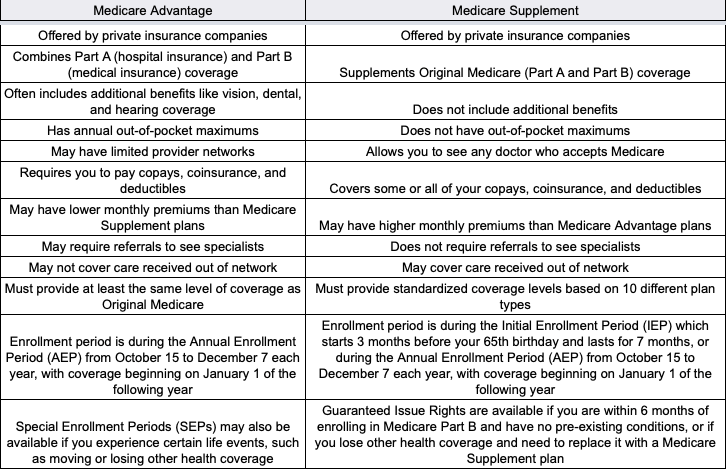

Medicare Advantage vs. Medicare Supplement Insurance: Comparison chart

Let’s take a quick overview of the difference between Medicare Advantage and Medicare Supplement Insurance.

Medicare Advantage vs Medicare Supplement comparison chart

Comparing Medicare Advantage Plans

If you’re considering Medicare Advantage plans, it’s important to know that there are different types available, and you’ll need to choose the one that’s best for you. The two most popular types are Health Maintenance Organization (HMO) and Preferred Provider Organization (PPO) plans.

HMO plans are common and require you to choose a primary care physician and receive care only from a specific network of doctors and hospitals. On the other hand, PPO plans offer a wider range of care, and you don’t have to select a primary care doctor. However, you may need to pay higher copayments if you receive care from physicians outside of your network, and PPO plans often have higher costs than HMO plans.

Most HMO and PPO plans also include prescription drug coverage as part of their benefits, but this is not always the case. Before choosing a plan, make sure that it also covers your required medications.

Which is the better option: Medicare Advantage or Medicare Supplement (Medigap)?

Since Medicare does not have a one-size-fits-all plan, the best policy for you is the one that best fits your healthcare needs.

Here are some factors to take into account when determining which plan, Medicare Advantage or Medicare Supplement, is more suitable for you:

- Are you more inclined to have all your coverage bundled into one plan?

- If yes, then a Medicare Advantage Plan might be the better option, as many of them come with Part D drug coverage, as well as vision, dental, and hearing benefits, based on the plan.

- Would you like financial protection from unforeseen out-of-pocket expenses, such as deductibles, copays, and coinsurance?

- If the answer is yes, then Medicare Supplement plans work in conjunction with Original Medicare and can assist with covering some of the remaining out-of-pocket expenses that Original Medicare doesn’t cover.

- Do you require a plan that offers coverage for disabilities or long-term care facilities?

- If so, Medicare Advantage provides Special Needs Plans that provide this type of coverage.

- Would you like the flexibility to see any doctor you choose?

- If so, Medicare Supplement plans don’t have a mandatory network, and you can see any doctor that accepts Medicare, even if you’re traveling or away from home. Some Medicare Advantage plans may also permit you to see doctors and hospitals outside of the plan’s network, which provides you with additional freedom to choose your doctors.

Frequently Asked Questions

Q: Can I switch from Medicare Advantage to Medigap?

A: Yes, you can switch from Medicare Advantage to Medigap during the annual open enrollment period (October 15th to December 7th). If you have been on Medicare for over a year, you will need to go through medical underwriting to determine the cost of you premium. Learn more about Medicare Enrollment Periods here.

Q: Can I have both Medicare Advantage and Medigap?

A: No, you cannot have both Medicare Advantage and Medigap. You must choose one or the other.

Q: Will Medigap cover all my medical expenses?

A: No, Medigap policies only cover the gaps in Original Medicare coverage. You’ll still need to pay for premiums, prescription drugs, and any services that aren’t covered by Medicare.

Conclusion:

When choosing between Medicare Advantage and Medicare Supplement, it’s not a matter of one being better than the other. Each plan provides unique coverage, so the best option for you depends on your healthcare needs and the type of coverage you’re seeking. It’s important to carefully review the details of each plan before making a decision and to remain open to considering alternative options if your needs change over time

Need help? Call Health Plans in Oregon: 503-928-6918. Our assistance is at no cost to you.

*By completing this form, you agree that an authorized representative or licensed insurance agent may contact you by phone,email,text, mail or face to face to answer your questions or provide additional information about your Medicare plan options. Not affiliated or endorsed by Medicare or any state or federal governmental agency.