What is Medicare Part A?

Typically, Medicare Part A is paid by Medicare taxes. So as long as you paid Medicare taxes while you were working, you shouldn’t have to pay a monthly premium for Part A Medicare coverage. If you don’t have enough work hours of 10 years’ worth or 40 quarters, you will have to pay for Part A.

Medicare Part A coverage is for inpatient hospital care including home health services, hospice care, medically necessary blood, hospital stays and skilled nursing facility care under the right conditions.

If you are receiving Social Security benefits, you may be eligible for Medicare Part A without paying a monthly premium, but there are still other costs associated with the coverage such as deductibles and coinsurance

What does Medicare Part A cover?

Inpatient Hospital Stays

Medicare Part A covers hospital services that you receive when you are admitted to a hospital on a doctor’s orders, including semi-private rooms, meals, general nursing, and drugs for inpatient treatments. However, if you want additional services such as a private room or private-duty nurse, you will have to pay for those costs yourself. It’s also important to note that if you need admittance to a psychiatric hospital for mental health treatment, it is covered under Part A, but with a limited coverage of 190 days over your lifetime. Most hospitals accept Medicare, which allows you to use Part A, but it’s worth noting that VA and military hospitals generally only accept VA and military insurances, not Medicare.

Medicare Part A covers inpatient hospital care in a variety of facilities, including:

- Semi-private (shared) room, meals, inpatient care at acute care hospitals

- Prescription drugs as part of your inpatient treatment

- Care at inpatient rehabilitation facilities

- Long-term care hospitals

- Critical access hospitals

- Inpatient care as part of a qualifying clinical research study

- Mental health care

Home Health Care

Individuals on Medicare who are unable to leave their homes may be eligible to receive certain healthcare services in their homes. Typically, a doctor must approve the situation and the services must be provided by a Medicare-certified agency. It’s important to note that Medicare does not cover 24-hour care at home, meal delivery, homemaker services if that’s the only care you need, or personal care such as bathing or dressing if that’s the only care you need. It’s important to research the services that are covered under Part A and which services would be your responsibility.

Medicare Part A also covers the following:

- Medically necessary part-time or intermittent skilled nursing care

- Physical therapy

- Speech therapy

- Continuing need for occupational therapy

- Medical social services

- Part-time or intermittent home health aide services

Hospice Care

Hospice care is the type of care you receive when you are terminally ill. The plan of care is determined by the hospice doctor and your medical doctor. Whether you use Original Medicare or a Medicare Advantage plan, Medicare Part A covers all of the costs for hospice care. To enter hospice, you will need to coordinate with your specific insurance plan.

Other covered services include:

- Prescription drugs for pain relief and symptom management (in some cases, you may need to make a copayment)

- Medical, nursing and social services

- Short-term inpatient care

- Homemaker services

- Physical, occupational and speech therapy

- Short-term inpatient stays for pain and symptom management (in a Medicare-approved facility)

- Respite care (a temporary stay in a Medicare-approved facility while your usual caregiver is unavailable or needs a break)

- Certain health problems that aren’t related to your terminal illness

- Grief counseling

Skilled Nursing Care Facility

With Medicare Part A, you can get coverage for short-term care at a certified skilled nursing facility after a minimum hospital stay of three days. The covered services include a semi-private room, meals, skilled nursing care and physical and occupational therapy when medically necessary.

Medicare Part A also covers additional services for your health and well-being, such as:

- Speech-language pathology services

- Medical social services

- Medications

- Medical supplies and equipment used in the facility

- Ambulance transportation to the nearest provider of services that are not available at your facility (if other transportation could harm your health)

- Dietary counseling

- Swing bed services

Transplants

At Medicare-approved facilities, Medicare may cover certain organ transplants and stem cell transplants:

- Heart

- Lung

- Kidney

- Pancreas

- Intestine

How much is Medicare Part A?

Medicare Part A is generally premium-free for those who have worked and paid taxes for at least 10 years in the United States. For those who have not met this criteria, the premium for Medicare Part A can vary depending on their work history.

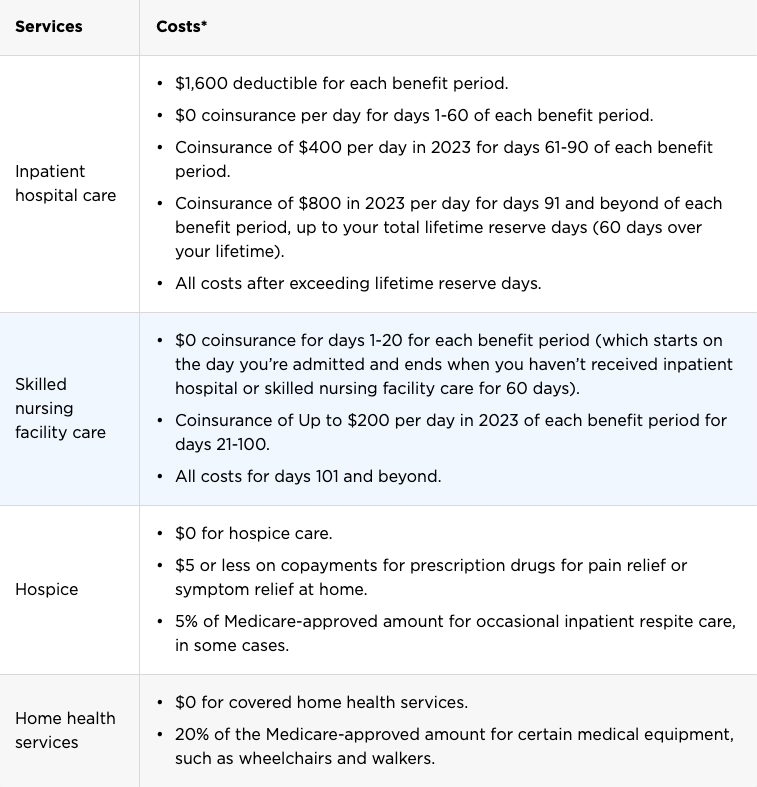

However, there are other costs that may apply, such as

- an annual deductible of $1,600 in 2023 for inpatient hospital stays,

- a daily coinsurance payment ranging from $400 to $800 for inpatient hospital stays,

- a 20% copay for Medicare-approved durable medical equipment, room and board costs for hospice care,

- and a coinsurance payment of $200 in 2023 for days 21 to 100 for a skilled nursing facility stay. Additionally, after day 100 and after the maximum 60 lifetime reserve days are exhausted, there is no more coverage under Part A for inpatient hospital stays.

Medicare Part A Eligibility

To be eligible for Medicare Part A, you typically need to meet one of the following criteria according to Medicare:

- You are age 65 or older.

- You have received disability benefits from Social Security or the Railroad Retirement Board for 24 months.

- You receive disability benefits due to Amyotrophic Lateral Sclerosis (ALS) or Lou Gehrig’s disease.

- You have end-stage renal disease and meet certain qualifications.

How do I know if I have Medicare Part A?

To confirm if you have Medicare Part A coverage, check for the label “Hospital (Part A)” on your red, white, and blue Medicare card. For further assistance, you can reach out to Social Security by calling 1-800-772-1213 or visiting a local security office. If your benefits come from the Railroad Retirement Board, you can contact them directly by calling 1-800-808-0772 or visiting a local office.

How to sign up for Part A?

You can sign up for Medicare Part A during your Initial Enrollment Period (IEP), which starts three months before the month of your 65th birthday and ends three months after that month. You can also sign up during the General Enrollment Period, which runs from January 1 to March 31 each year.

To apply for Medicare Part A, you can:

- Visit the Social Security Administration website and apply online

- Visit a local Social Security office

- Call Social Security at 1-800-772-1213 and apply over the phone

You may also be automatically enrolled in Medicare Part A if you are already receiving retirement benefits from Social Security or the Railroad Retirement Board.

It’s important to note that there may be a premium for Part A, but most people don’t pay a monthly premium for Part A because they or a spouse already paid for it through their taxes while working.

If you’re looking for health insurance coverage under Medicare, Part A and Part B coverage are the traditional options, but you can also consider a Medicare Advantage plan, which may offer additional benefits at a higher monthly cost, starting from the month you turn 65.

Need help? Call Health Plans in Oregon: 503-928-6918. Our assistance is at no cost to you.

Get free help from your local, licensed, certified, 5 star reviews and well experienced licensed insurance agent.

*By completing this form, you agree that an authorized representative or licensed insurance agent may contact you by phone,email,text, mail or face to face to answer your questions or provide additional information about your Medicare plan options. Not affiliated or endorsed by Medicare or any state or federal governmental agency.